The Essential Importance of Risk Management in Monetary Decision Making

The Importance of Understanding the Importance of Risk Management in Various Industries

The Core Idea of Risk Management and Its Objective

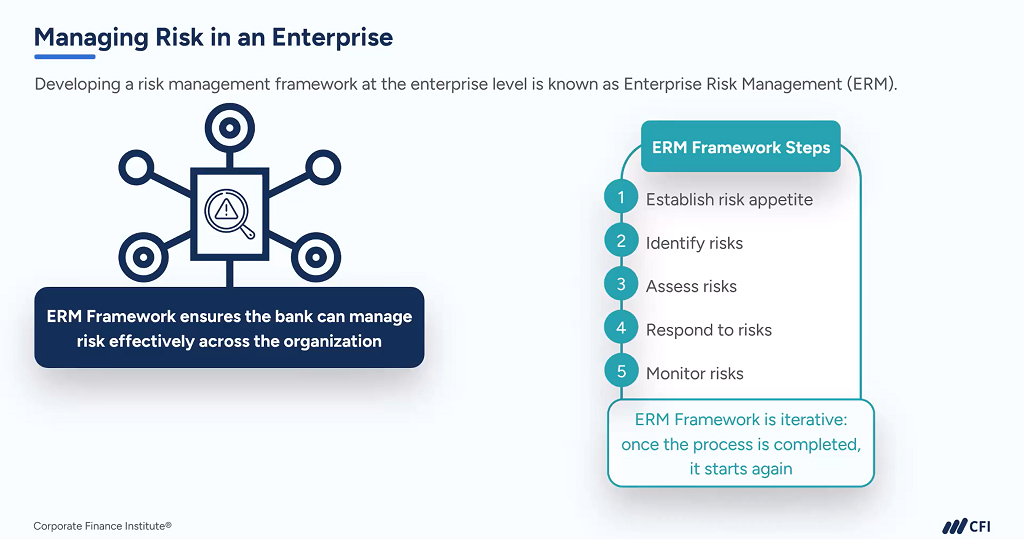

Risk Management, the foundation of several markets, pivots on the identification, analysis, and mitigation of unpredictabilities in a business atmosphere. By correctly determining possible threats, companies can develop techniques to either stop these risks from happening or reduce their effect. As soon as risks have been identified and examined, the reduction process involves devising techniques to minimize their possible effect.

Advantages of Implementing Risk Management in Company Procedures

Revealing the Role of Risk Management in Different Industries

While every sector confronts its distinct set of dangers, the implementation of Risk Management techniques stays a common measure in their pursuit of sustainability and development. In the health care sector, Risk Management involves ensuring client safety and information security, while in money, it involves mitigating investment risks and ensuring regulative compliance (importance of risk management). Building and construction companies focus on worker safety, job view website hold-ups, and budget plan overruns. In the technology sector, companies alleviate cybersecurity threats and innovation obsolescence. Eventually, the function of Risk Management throughout industries is to identify, assess, and mitigate threats. It is an important element of calculated planning, allowing companies to shield their assets, optimize opportunities, and accomplish their goals.

Real-life Study Showing Effective Risk Management

To recognize the relevance of Risk Management in these lots of sectors, one can look to a number of real-life circumstances that show the effective application of these measures. Toyota, post the 2011 earthquake in Japan, modified its supply chain Management to lessen interruption risks. These cases demonstrate just how industries, finding out from dilemmas, effectively used Risk you can find out more Management techniques to decrease future dangers.

Future Fads and Developments in Risk Management Approaches

Cybersecurity, as soon as a peripheral issue, has actually catapulted to the center of Risk Management, with strategies concentrating on avoidance, detection, and reaction. The integration of ESG (Environmental, Social, Administration) aspects into Risk Management is an additional growing trend, reflecting the increasing acknowledgment of the function that environmental and social risks play in organization sustainability. Therefore, the future of Risk Management lies in the fusion of innovative innovation, innovative methods, and a holistic technique.

Conclusion

In verdict, understanding the relevance of Risk Management across a spectrum of sectors is critical for their long life and success. Tailored approaches can aid reduce possible threats, protect assets, and foster stakeholder depend on. Furthermore, proactive decision-making aids in regulatory compliance and optimizes resource use. Eventually, effective Risk Management adds to more lasting and resilient services, highlighting the importance of this practice in today's dynamic and highly competitive company environment. visit this website

While every industry challenges its distinct collection of risks, the implementation of Risk Management methods continues to be an usual denominator in their pursuit of sustainability and development. In the healthcare industry, Risk Management requires making sure patient safety and security and data security, while in finance, it involves mitigating investment risks and making certain regulatory compliance. Ultimately, the duty of Risk Management across sectors is to identify, assess, and reduce threats. These situations show just how industries, discovering from situations, properly applied Risk Management methods to reduce future threats.